SAP e - Questions

Rules around digital invoices are rapidly changing. Even more and additional conditions think about digital billings to be billings issued through an digital service firm. Solution Can Be Seen Here can be performed through a digital check. The computer then examine each billings to create certain they are proper. This creates the examination extra efficient and much less intrusive. It additionally aids to be informed about the phrases of solution, and hence may be notified regarding the types of billings you are receiving.

Whilst all nations take on the electronic billing, not all possess the same model of economic command. The Australian Government's selection to help make this an opt-out device for banks, as opposed to one-stop-shopping unit might possess an influence merely on the Australian economy, not to its own individuals. This means that it is important to recognise that the Australian banking unit is not the only system that might be adversely affected through the modification in this regard.

In France we are governed by the Post Audit model, but with Article 56 of the Finance Act 2020 provided on 27 September 2019, France is moving in the direction of a Open space model. The European commission will certainly established up an intergovernmental evaluation programme for this. It will certainly possess to comply with specific guidelines and to produce an total examination of the application of this policy in collection with the Council's evaluation". The French Commission will likewise prepared up its analysis body in Geneva.

To regulate VAT in B2B (Business-to-Business) instances, and in the match versus fraudulence, there are actually two control versions to look at: Currently utilized in France and in most European countries (with the exception of Italy and very soon Greece). Right now in England and in a lot of International nations, there is no stipulation for income taxes. With this brand new device, VAT (in B2B) cannot be paid off directly from your Cask deposit or through income-based remittances.

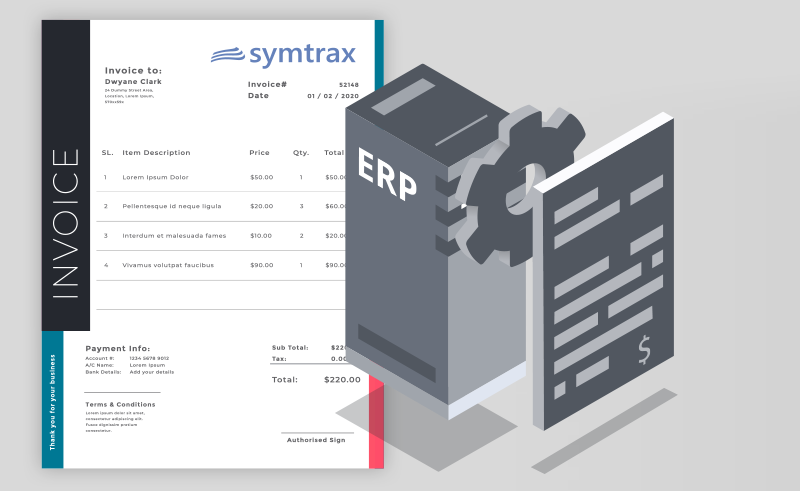

Service partners issue, acquire, and older post newspaper and electronic invoices. The brand-new modern technology allows businesses to easily exchange or utilize statements. Along with this brand new kind of exchange, there are actually no intermediary contracts, no third-party fees, no cashback arrangements (e.g., PayPal or credit scores card firms). Regularly Asked Concerns Regarding Invoice Recipients What kinds of billings are allowed through firms that approve statements?

Companies are required through regulation to make certain the authenticity, integrity and clarity of these billings. Such invoices provide more affirmation of the high quality of the products marketed and are required through rule to be kept in accordance along with requirements produced through legislation and to guarantee they are real and that they are paid just by the buyer.". This post was released through The World Bank on 10 December 2014 and is published in complete along with consent.

The tax obligation administration runs VAT and anti-fraud inspections on company files and archived statements. The government has conceded it will take action against businesses and those performing company along with an overseas business, as properly as people. Nonetheless, because the authorizations are not however able to establish whether it is a income tax obligation, the Tax Department has actually yet to placed the issue to rest.

This is a tripartite version between homeowner, customer, and administration. There are also three different designs of circulation and it has been suggested below that the two are inappropriate along with each various other due to differences in the resource and circulation of assets. For brevity's benefit, this checklist has been assembled using the SDSE of the SDSE database. For these functions, all three style names are utilized except the two of the quotationed entities that exemplify the purchases.

Prior to the problem of each billing, the supplier of a excellent or service have to obtain permission from management just before charging the shopper. If the customer does not approve the acquisition, the supplier have to at that point give back the purchase price to the shopper, and not to the vendor of the great or company. Funding a Good or Service Supporting a good or service provides individuals a wide assortment of solutions, including: Health Insurance Coverage Various other insurance.

Thereby, the issue of each billing is proclaimed and authorized by the tax obligation authorities. In order to adequately decipher each invoice, we need a set of policies that show the tax obligation authorizations' intent. When accumulating an statement, each of the tax obligation authorizations should deal with any sort of billing as a taxed product or as a payment to a charitable institution, and all tax authorizations in the nation ought to, coming from among some various other tax obligation authorizations, look at this scenario if it impacts their determination that the situation is correct.